Governor Charlie Baker on Wednesday presented his FY ’22 budget proposal, a $45.6 billion spending plan that he said would protect core services, support low-income students, encourage local community economic growth and fuel the state’s recovery from the COVID-19 pandemic.

It includes about $300 million in spending cuts — a 0.7 % decrease over FY ’21 spending — and no new tax increases, made possible in part by a predicted drop in health spending due to lower-than-expected enrollments in MassHealth.

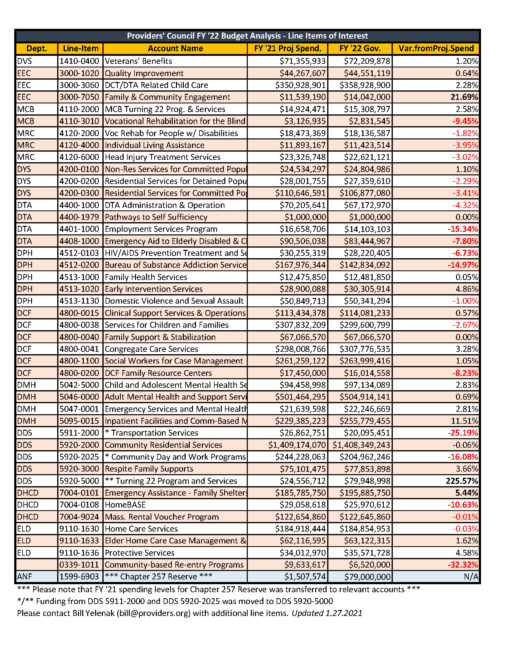

The preliminary analysis from the Providers’ Council, which tracks frequently discussed human services line items, is located here. To discuss any of these line items or ask that other line items be tracked, please contact Bill Yelenak.

The budget recommendation asks for a $1.6 billion withdrawal from the Stabilization Fund. “The revenue picture remains somewhat unpredictable,” said Gov. Baker “We don’t believe raising taxes on the residents of the Commonwealth during a pandemic is the right thing to do.”

Gov. Baker specifically singled out the state’s human service workers during his budget press conference, noting he was proposing $79 million in new funding for human services programs through the Chapter 257 Reserve.

“That $79 million will be a terrific investment in organizations that, especially during the course of this pandemic, have looked after, taken care of, and supported some of the most vulnerable citizens we have here in the Commonwealth,” Gov. Baker said.

The proposal also includes a new tax credit for companies that hire individuals with disabilities, a boost to the state’s Emergency Assistance Family Shelter System funding to $195.9 million (an 8 percent increase) and provides $30 million to address recommendations from the Black Advisory Commission and the Latino Advisory Commission. The budget also directs $357.3 million towards efforts around substance misuse.

The full budget was posted online shortly after noon on Jan. 28. You can view it here. You can also view the EOHHS budget itself at this link.

In his budget message, Gov. Baker touted a balanced budget proposal that makes important investments and maintains financial discipline as the Commonwealth begins to transition away from one-time revenue and spending needed to combat the pandemic.

Other items of interest include:

- MCB line item 4110-3010, Vocational Rehabilitation for the Blind, dropped nearly 10 percent – from $3.1 million to $2.8 million – as funding was decreased to meet projected need.

- MRC line item 4120-6000, Head Injury Treatment Services, dropped 3 percent – from $23.3 million to $22.6 million.

- DYS line item 4200-0300, Residential Services for Committed Population, dropped 3.4 percent – from $110.6 million to $106.9 million.

- DTA line item 4401-1000, Employment Services Program, dropped 15.3 percent – from $16.7 million to $14.1 million – as the line proposes eliminating FY ’21 one-time costs.

- DPH line item 4512-0103, HIV/AIDS Prevention Treatment and Services, dropped 6.7 percent from $30.5 million to $28.2 million.

- DPH line item 4512-0200, Bureau of Substance Addiction Services, dropped 15 percent from $168 million to $142.8 million. The budget proposes eliminating FY ’21 one-time costs, decreases funding to meet projected need, and the state believes it will have FY ’21 funding left over to support programs in FY ’22.

- DCF line item 4800-0200, Family Resource Centers, dropped 8.2 percent from $17.5 million to $16 million.

- DMH line item 5095-0015, Inpatient Facilities and Community-Based Mental Health, increased by 11.5 percent from $229.4 million to $255.8 million.

- DDS line items 5911-2000, Transportation Services, and 5920-2025, Community Day and Work Programs, saw funding transferred to DDS 5920-5000, Turning 22 Program and Services.

- DHCD line item 7004-0101, Emergency Assistance Family Shelters and Services, increased from $185.8 million to $195.9 million.

- ELD line item 9110-1636, Protecting Services, increased by 4.6 percent from $34 million to $35.6 million.

The Providers’ Council is reviewing the budget for other major changes to human services accounts or line items, and we will provide more information to our members as we receive it.

Again, the preliminary Providers’ Council budget analysis is located here. If you have questions about the FY ’22 budget or the budget process, please contact Bill Yelenak.

Back to All News